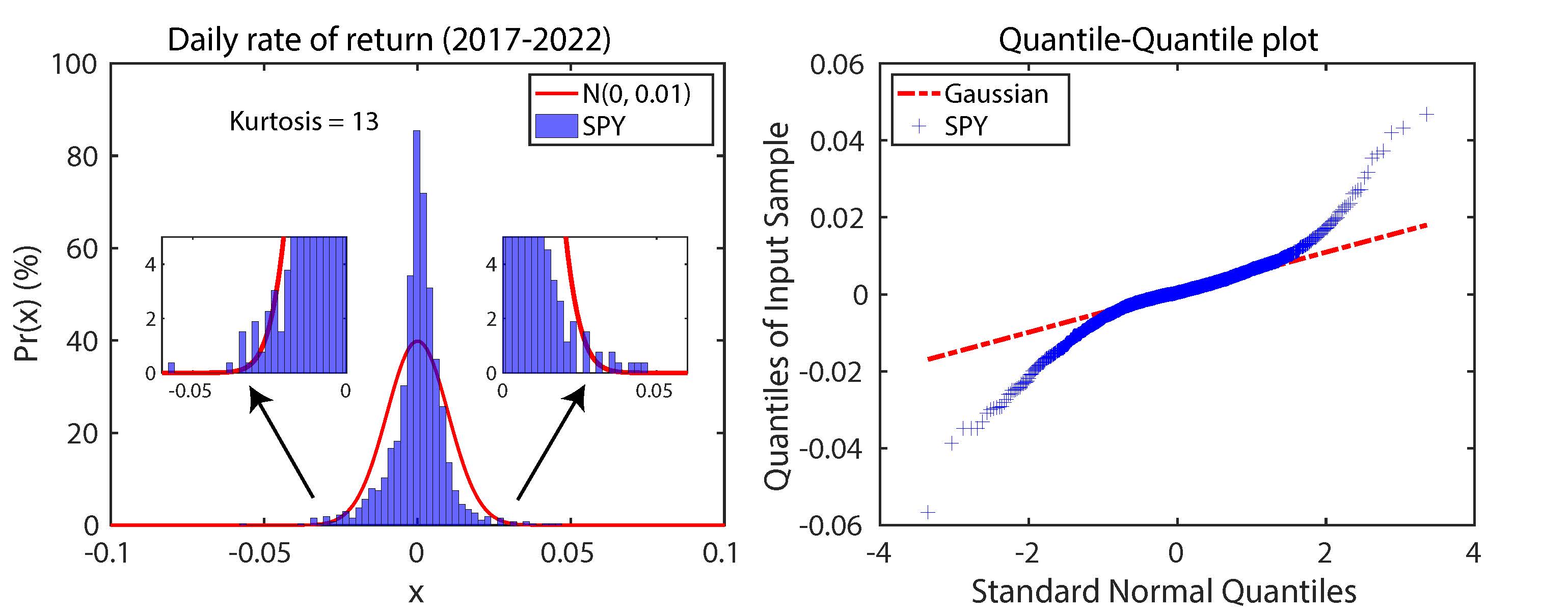

Broadly, my PhD research is about human and reinforcement learning (RL) agents‘ learning and behaviour in financial markets where the environment contains frequent tail risks.

Study 1 (Published)

In chapter 1, we asked how the tail risk events would affect canonical RL and distributional RL agents.- TitleExploiting Distributional Temporal Difference Learning to Deal with Tail Risk

- Linkhttps://www.mdpi.com/2227-9091/8/4/113/

- GithubDistributional-RL-Tail-Risk

- CodingPython

Study 2 (Under Review)

In chapter 2, we ran a human behavioural experiment to examine if human concern for statistical efficiency in the presence of tail risks.- TitleConcern for statistical efficiency guides human reward estimation

- CodingUnity C# (UI), Python (Server), Matlab/R (Analysis)

Study 3 (Draft)

In chapter 3, we seek to explain the source of tail risks in the financial market. Is intelligence the key factor in generating tail risks?- TitleImpact of a Liquidity Provider on Economic Welfare and Tail Risks in an Economy with Gaussian Fundamentals

- CodingPython (Trading Robots and Analysis), Matlab/R (Analysis)